Summary The ultimate test of corporate strategy, the only reliable measure, is whether it creates economic value for shareholders. Now, in this substantially revised and updated edition of his 1986 business classic, Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. After a decade of downsizings frequently blamed on shareholder value decision making, this book presents a new and indepth assessment of the rationale for shareholder value. Further, Rappaport presents provocative new insights on shareholder value applications to: (1) business planning, (2) performance evaluation, (3) executive compensation, (4) mergers and acquisitions, (5) interpreting stock market signals, and (6) organizational implementation. Readers will be particularly interested in Rappaport's answers to three management performance evaluation questions: (1) What is the most appropriate measure of performance?

(2) What is the most appropriate target level of performance? And (3) How should rewards be linked to performance? The recent acquisition of Duracell International by Gillette is analyzed in detail, enabling the reader to understand the critical information needed when assessing the risks and rewards of a merger from both sides of the negotiating table. The shareholder value approach presented here has been widely embraced by publicly traded as well as privately held companies worldwide. Brilliant and incisive, this is the one book that should be required reading for managers and investors who want to stay on the cutting edge of success in a highly competitive global economy. THE FREE PRESS THE FREE PRESS A Division of Simon & Schuster Inc. 1230 Avenue of the Americas New York, NY 10020 www.SimonandSchuster.com Visit us on the World Wide Web: Copyright © 1986, 1998 by Alfred Rappaport All rights reserved, including the right of reproduction in whole or in part in any form.

Rappaport Alfred 1998 Creating Shareholder Value A Guide for Managers and from FINANCE 102 at Mindanao State University. Rappaport, Alfred, and Michael J. Fallout 2 save editor. Financial Ratios Business Economics Analysis of Firm’s Future Projections of Financial Statements Spreadsheets of Value Driver Data for Valuation Valuation Sensitivity.

THE FREE PRESS and colophon are trademarks of Simon & Schuster Inc. ISBN 0-684-84456-7 ISBN-13: 978-0-684-84456-5 eISBN: 978-0-684-84456-5 Dedication TO SHARON CONTENTS List of Illustrations Preface Chapter 1. SHAREHOLDER VALUE AND CORPORATE PURPOSE Management Versus Shareholder Objectives Shareholders and Stakeholders Shareholders Are Us Chapter 2. SHORTCOMINGS OF ACCOUNTING NUMBERS Earnings—An Unreliable Bottom Line The Trouble with Accounting Return on Investment (ROI) ROI Versus DCF Return Illustrated Additional Shortcomings of ROI Shortcomings of Return on Equity (ROE) Chapter 3. SHAREHOLDER VALUE APPROAch Estimating Shareholder Value Estimating Shareholder Value Added (SVA) Threshold Margin The Shareholder Value Network Appendix: Conventional Versus Shareholder Value Break-Even Analysis Chapter 4.

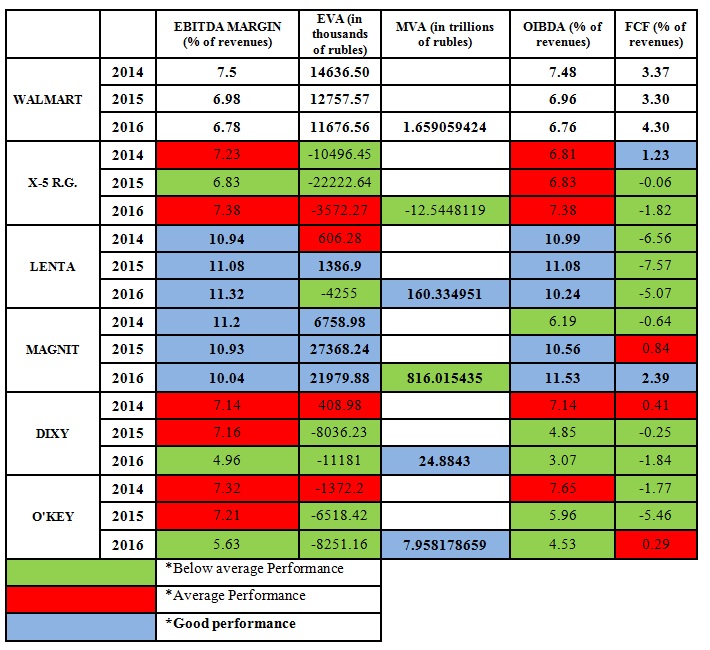

FORMULATING STRATEGIES Strategy Formulation Process Competitive Advantage and Shareholder Value Strategy Best Sellers Chapter 5. VALUING STRATEGIES Strategy Valuation Process Valuing Alternative Business Opportunities Valuing Interdivisional Synergies choosing Optimal Investment Level for a New Business Do Stock Repurchases Create Value? Ten Value-Creation Questions Chapter 6. STOCK MARKET SIGNALS TO MANAGEMENT Reading the Market Corporate Versus Shareholder Rate of Return Management Implications Chapter 7. PERFORMANCE EVALUATION AND EXECUTIVE COMPENSATION CEOs and Other Corporate-Level Executives Operating Managers Performance Evaluation Alternatives—Shareholder Value Added (SVA) Performance Evaluation Alternatives—Residual Income Performance Evaluation Alternatives—Economic Value Added (EVA) Performance Evaluation Alternatives—change in Residual Income or change in EVA Leading Indicators of Value Target Level of Performance Linking Rewards to Superior Performance Chapter 8. MERGERS AND ACQUISITIONS The Acquisition Process Value Creation Framework Do Mergers Create Value for the Acquiring Company? Gillette s Acquisition of Duracell International Premium Advice for Targets Chapter 9.